Morocco is selling its first euro-denominated bonds in five years as it boosts spending for the football World Cup it’s co-hosting in 2030.

The sale of a combined €2 billion ($2.2 billion) in four- and 10-year notes has attracted total bids of more than €6.75 billion, according to a person familiar with the matter. The sale, the North African nation’s first foray into euro bonds since 2020, is €500 million larger than earlier expected.

The country is raising money as it prepares to co-host the 2030 FIFA World Cup along with Spain and Portugal. It’s encouraging a landmark investment drive, with the central bank cutting interest rates for a second consecutive time last week to ease local borrowing costs.

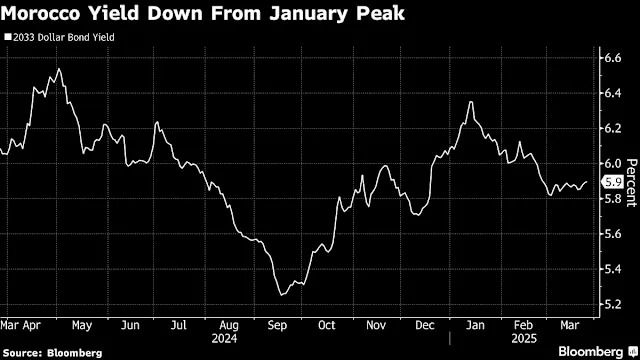

The final spread at 155 basis points over midswaps for the four—year note compares with initial price talk in the 190 basis points area. For the 10-year note, it’s at midswaps plus 215 basis points, also narrower than initial talk. Morocco, which holds the highest non-investment grade at all three main rating companies, last sold $2.5 billion of dollar debt in 2023, with the bonds rallying so far this year.

The bookrunners for the sale are BNP Paribas SA, Citigroup Inc., Deutsche Bank AG and JPMorgan Chase & Co., while Lazard Inc. is acting as an adviser.

(Some insight were gotten from Bloomberg)